Development and demonstration project of Nature Footprint for

promoting Nature-related Financial Disclosures

by investors and financial institutions and international standardization

ABOUT OUR PROJECT

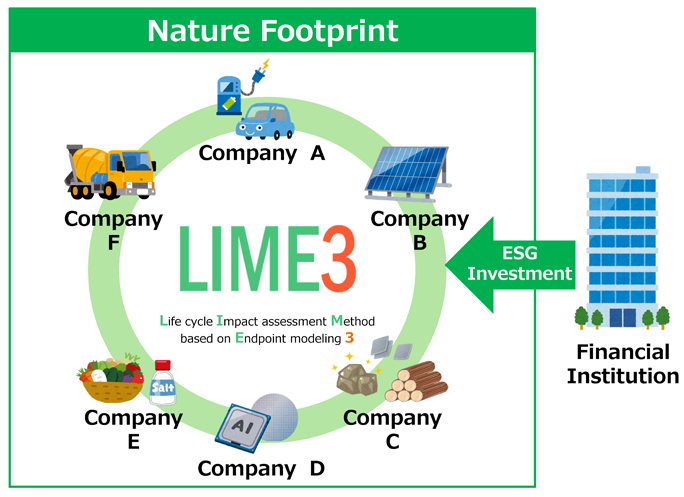

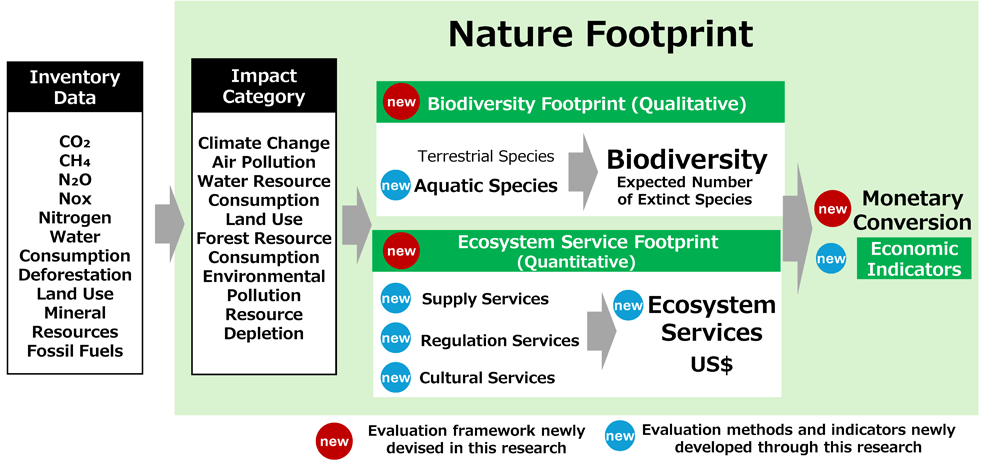

Waseda University and Value Management Institute, Inc. launched a project of "Development and Demonstration Project of Nature Footprint on the premise of promoting natural information disclosure and international standardization by financial/investment institutions" in October 2024. This project aims to design a nature-centric assessment approach in Life Cycle Assessments (LCAs), demonstrate its practical application through partnerships with financial institutions and domestic enterprises, and promote its global adoption as an essential sustainability evaluation tool.

NEWS

News

2025.06.11

Report on the BRIDGE Methodology Development and Industry Working Group Meeting(May 20, 2025)

News

2025.03.17

Report on the BRIDGE Methodology Development and Industry Working Group Meeting (March 17, 2025)

News

2025.03.06

We have launched our website.

News

2025.06.11

Report on the BRIDGE Methodology Development and Industry Working Group Meeting(May 20, 2025)

News

2025.03.17

Report on the BRIDGE Methodology Development and Industry Working Group Meeting (March 17, 2025)

News

2025.03.06

We have launched our website.

ABOUT

MESSAGE

Pursuing nature-positive initiatives, carbon neutrality, and a circular economy now requires companies to both reduce environmental impacts across their entire supply chains and transparently disclose these efforts. The development of the Nature Footprint framework addresses critical shortcomings in traditional LCA methods by enabling more detailed evaluations that capture the unique characteristics of species and regions, thus allowing domestic companies to better understand the intersection between their operations and the natural environment.

Moreover, a comprehensive assessment of supply chain dependencies on and impacts to natural systems necessitates using both biodiversity footprints and ecosystem service footprints. By integrating a quantitative evaluation of ecosystem services—a factor that has been largely overlooked in many existing LCA approaches,while the Nature Footprint methodology demonstrates a clear technical advantage.

In the financial sector, where the demand for biodiversity considerations is intensifying, the Nature Footprint’s ability to provide integrated, quantitative analyses of natural dependencies and impacts is particularly valuable. Financial institutions, especially those engaging with companies highly dependent on natural capital, are expected to increasingly adopt this tool.

Ultimately, by promoting the widespread adoption of the Nature Footprint, we aim to make domestic companies’ efforts to reduce environmental impacts more visible and to foster a society where nature-positive initiatives are appropriately recognized and valued.

As natural capital disclosure becomes a global imperative, a primary challenge is determining which indicators to adopt and establishing robust quantification methodologies. Although numerous ecosystem evaluation frameworks have been proposed, many are limited by insufficient consideration of value chains and a lack of capability to perform company- or product-specific analyses.

This study advances the nature footprint impact assessment method by building on LIME model (Life cycle Impact assessment Method based on Endpoint modeling), a well-established approach in LCIA. Our methodology assesses extinction risks for over 10,000 species—including both terrestrial and aquatic ecosystems—and evaluates ecosystem services across 15 biomes. It comprehensively addresses multiple impact categories, such as climate change, water consumption, land use, and resource depletion, with final outcomes expressed in economic terms.

The developed framework will be integrated into widely used LCA software, thereby providing practitioners with a streamlined, user-friendly tool. By enabling high-resolution, life cycle-based analyses, the nature footprint is poised to become an essential approach for corporate strategic planning, governmental and municipal environmental policy development, and investment decision-making by financial institutions.

As ESG finance gains traction, the integration of non-financial data—encompassing environmental, social, and governance (ESG) factors—into corporate valuation is becoming increasingly standard, with the scope of assessment expanding. Natural capital has emerged as a critical focus area. Effective integration of natural capital into corporate value creation requires robust and transparent information disclosure. With frameworks like the TNFD now in place, efforts to develop complementary tools are accelerating, notably through the introduction of nature footprints. This methodology systematically evaluates dependencies and impacts on natural capital across the value chain, unlocking new opportunities for financial institutions in non-financial data analysis. By leveraging this approach, financial institutions can enhance portfolio management, strengthen engagement with investee companies, and drive the development of innovative financial products.

PROJECT

PROJECT OVERVIEW

October 2024 saw the formal activation of the " Development and demonstration project of Nature Footprint for promoting Nature-related Financial Disclosures by investors and financial institutions and international standardization " initiative, a flagship program anchored within the " Bridging the gap between R&d and the IDeal society (society 5.0) and Generating Economic and social value (BRIDGE)" policy framework spearheaded by the Japanese Cabinet Office.

Human economic activities are primary drivers of global ecological crises, with climate change and biodiversity degradation now recognized as environmental risks. Institutional investors are strategically integrating environmental, social, and governance (ESG) metrics into decision-making processes, compelling corporations to achieve measurable impact reduction while meeting rigorous disclosure standards. This paradigm shift positions the Nature-Footprint as the emerging gold standard for environmental impact quantification, attracting significant attention.

However, the evaluation indicators widely employed by the EU and other entities have initially remained limited in scope for evaluating impacts on natural systems. Specifically, assessments of biodiversity impacts, and the economic valuation of ecosystem services have been conducted separately, with no existing integrated models. To address this gap through synergistic integration of two core components: This initiative establishes a knowledge alliance between two pioneering research streams: Theme 1: "Evolution of Nature Footprint Methodology through LIME Extension" (Lead: Waseda University, Prof. Norihiro Itsubo, Faculty of Science and Engineering). Theme 2: "Operationalizing Nature Footprint in Financial Decision Systems" (Lead: Value Management Institute, Inc., Kiyoshi Yamasaki). Through cross-sectoral collaboration, we are advancing the LIME3 (Life cycle Impact assessment Method based on Endpoint modeling 3) to pioneer a unified nature footprint framework that systematically integrates biodiversity metrics and ecosystem service valuation models.

By integrating cutting-edge modules for biodiversity risk and ecosystem service valuation into LIME3, we are pioneering a holistic nature-economy modelling framework. Through a strategic consortium comprising financial institutions, industry leaders, and sustainability consultancies, this initiative will validate implementation protocols and drive global standardization of the methodology as a next-generation ESG disclosure infrastructure.

OUR RESEARCH

In this research, we will develop an impact assessment method for nature footprint by advancing LIME model (Life cycle Impact assessment Method based on Endpoint modeling), which is one of the impact assessment methods of LCA.

Specifically, we will conduct research focusing on the following:

(1) Evaluating both quality and quantity: While the significance of biodiversity has been well-emphasized in the conventional life cycle assessment methodologies, our research pioneers an innovative framework that systematically integrates ecosystem service valuation into impact quantification, establishing a new paradigm for nature-positive economic modeling.

(2) Enhancing comprehensiveness and regional resolution: We cover a wide range of impact categories—including climate change, land use, and pollution, and extend our evaluation to both terrestrial and aquatic ecosystems. Additionally, for areas like land use and resource extraction, where impacts vary by region, a higher-resolution evaluation factor will be developed.

(3) Development of economic evaluation methods: By developing economic evaluation methods that are easier for financial institutions and business companies to interpret and utilize, we will provide indicators to support the formulation of management strategies.

(4) Enhancing the implementation: The developed evaluation method will be implemented as a standard feature in widely used Life Cycle Assessment (LCA) software both domestically and internationally, to facilitate easy utilization by LCA practitioners.

The evaluation method developed in this study is expected to assist companies with nature-related disclosures and support financial institutions in their investment decision-making. Furthermore, these findings will be consolidated into guidelines and presented at international conferences to foster their global adoption.

TEAM

THEME 1

Co-Investigator

MOTOSHITA, Masaharu

Research Team Leader, National Institute of Advanced Industrial Science and Technology

Co-Researcher

Kamrul Islam

Senior Researcher, National Institute of Advanced Industrial Science and Technology

Co-Researcher

YOKOI, Ryosuke

Senior Researcher, National Institute of Advanced Industrial Science and Technology

Co-Researcher

Slim Mtibaa

Senior Researcher, National Institute of Advanced Industrial Science and Technology

Co-Investigator

Longlong Tang

Senior Researcher, National Agriculture and Food Research Organization

Co-Researcher

SASAKI, Yuma

Researcher, National Agriculture and Food Research Organization

Co-Investigator

OHASHI, Haruka

Senior Researcher, Forestry and Forest Products Research Institute

THEME 2

Representative Organization

Value Management Institute, Inc.

Partner institutions

National Graduate Institute for Policy Studies / Nikken Sekkei LTD. / NIKKEN SEKKEI RESEARCH INSTITUTE / Ajinomoto Co., Inc. /

TOYOTA MOTOR CORPORATION / SEKISUI CHEMICAL CO., LTD. / Sumitomo Forestry Co., Ltd. / Shiseido Company, Limited / AGC Inc. /

JX Advanced Metals Corporation / TAIHEIYO CEMENT CORPORATION / Panasonic Holdings Corp. / NEC Corporation /

Nippon Paper Industries Co., Ltd. / KAJIMA CORPORATION / SHIMIZU CORPORATION / TAISEI CORPORATION / Honda Motor Co., Ltd. / Hitachi, Ltd. /

Seiko Epson Corporation / SUMITOMO CHEMICAL COMPANY, LIMITED / LIXIL Corporation / The Norinchukin Bank /

MS&AD Insurance Group Holdings, Inc. / Mitsubishi UFJ Trust and Banking Corporation / Sumitomo Mitsui Banking Corporation /

The Shizuoka Bank, Ltd. / The Joyo Bank, Ltd. / LCA expert center Co., Ltd. / Sustainable Management Promotion Organization / TCO2 Co.,Ltd. /

MS&AD InterRisk Research & Consulting, Inc.

ACHIEVEMENTS

For the complete and most up-to-date list, please visit our Japanese publications page.